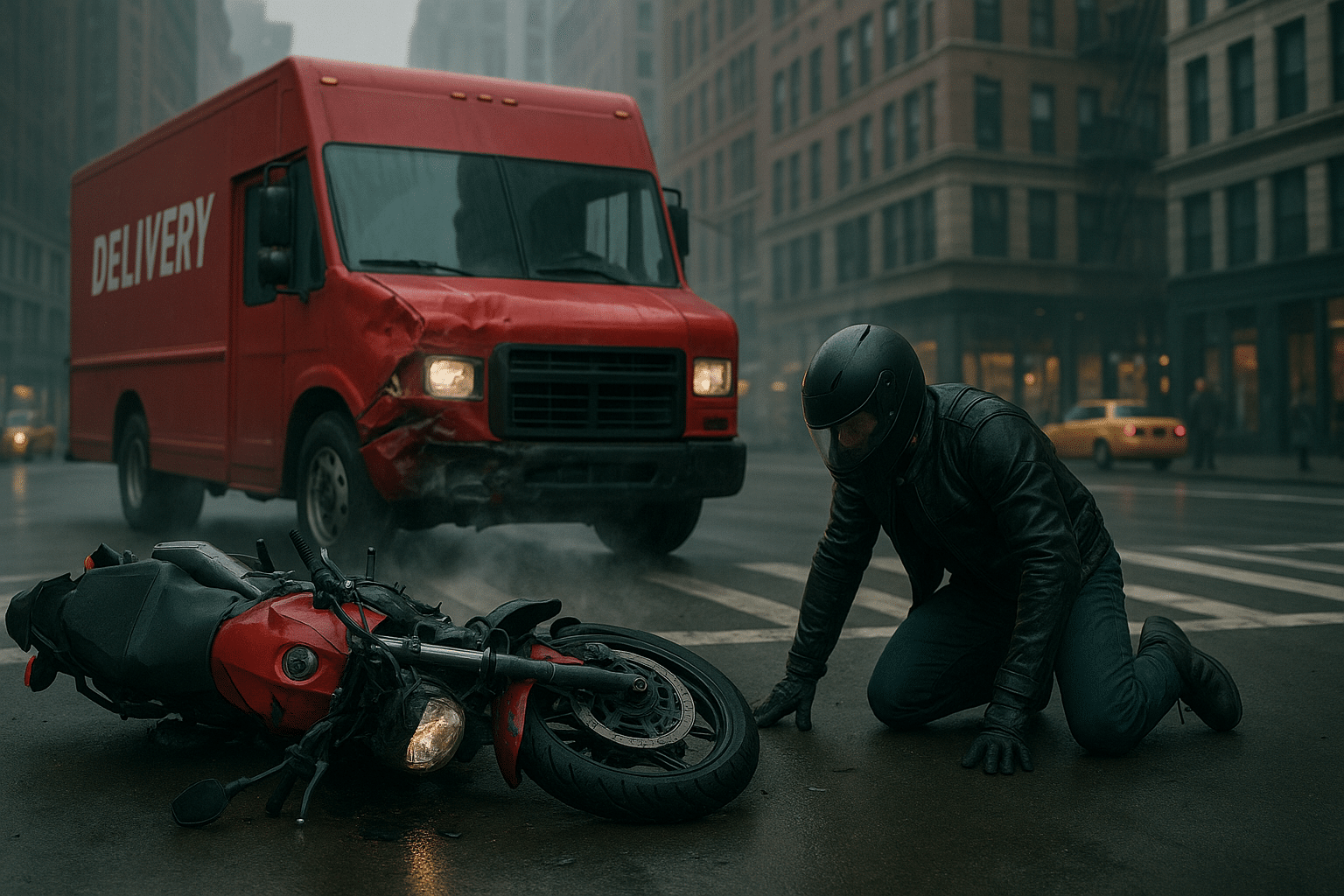

Suffering a motorcycle accident can be devastating. Injuries are often severe, the bike becomes unusable, and medical expenses start piling up from day one.

But there’s a key question every motorcyclist asks after a crash:

What does my insurance really cover?

The answer isn’t always clear. And many times, what you thought was covered… isn’t.

Table of Contents

We return our clients’ phone calls. We are available 24/7, 365 days a year. I give out my personal cell phone number to all my clients, and I tell them they can feel free to contact me at any time. That’s what makes us different.

—Mitchell Proner

Not all insurance policies cover the same

Motorcycle insurance policies can vary widely depending on:

- The type of coverage purchased

- The state where the accident happened

- Who was considered at fault

In New York, there are certain mandatory minimums, but many people discover after the accident that their coverage is limited or even ineffective.

Most common coverages (and what they really mean)

- Liability

Covers damages you cause to other people or property.

Does not cover your injuries or damage to your motorcycle. - Uninsured/Underinsured Motorist Coverage (UM/UIM)

Protects if the other driver has no insurance or insufficient coverage.

Key in hit-and-run or avoidance of responsibility cases. - Collision Coverage

Pays for damage to your motorcycle regardless of who was at fault.

Usually has a deductible. - Personal Injury Protection (PIP)

In New York, PIP does not always apply to motorcyclists, which can leave you exposed.

It’s crucial to check if you have it and what it covers. - Medical Payments (MedPay)

Helps pay for initial medical expenses but usually has low limits.

With 30 years of experience winning top settlements, we know how to deal with insurance companies and the legal system. You’re in the best hands with us.

—Mitchell Proner

What insurance never tells you

Insurance companies aren’t on your side. Their goal is to pay as little as possible. And many times they:

- Fail to explain important coverages

- Deny claims citing technicalities

- Offer low “quick” payments to avoid lawsuits

- Delay processes until you get frustrated

Even if you pay your insurance religiously, you could face denial when you need it most.

What to do after an accident

- Seek immediate medical attention.

Your health comes first, and it also strengthens your claim. - Don’t give extensive statements to the insurer without legal advice.

Anything you say can be used to reduce your payment. - Document everything.

Photos, bills, medical reports, statements from the other driver, etc. - Consult a specialized lawyer.

A lawyer will know which coverages apply, how to respond to denials, and how much you could actually receive.

How much can your insurance cover?

Every case is different, but with the right policy you could claim:

- Current and future medical expenses

- Damage to your motorcycle

- Lost income due to disability

- Pain and suffering

- Compensation for permanent injuries

But none of this will happen if you let the insurer handle your case without legal defense.

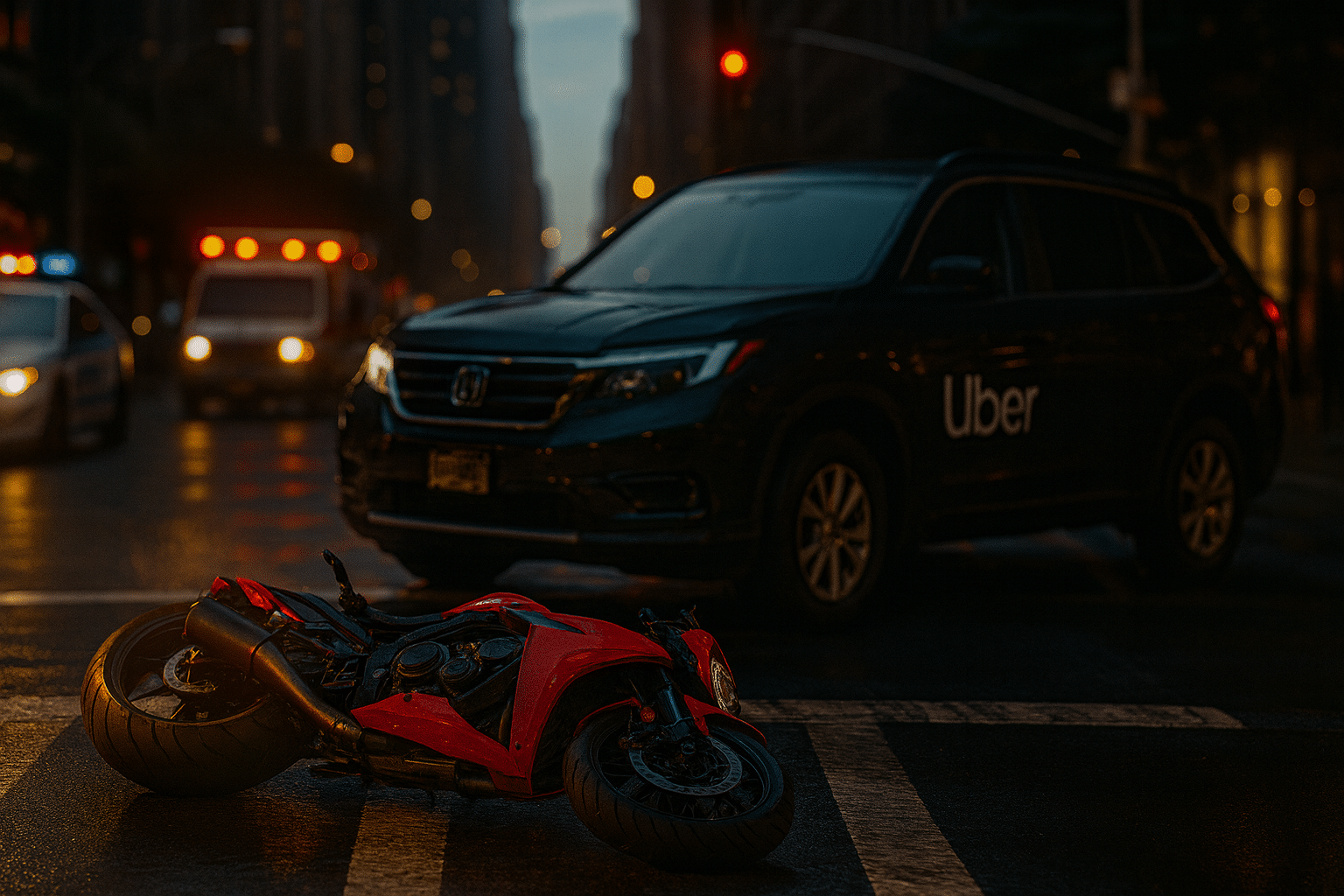

Beware of NYC rules

New York has specific rules for motorcyclists. Some insurers exploit legal loopholes to avoid covering certain accidents.

In areas like Queens, Brooklyn, the Bronx, and other metro areas, motorcycle accidents are increasing. Having a local lawyer who knows these rules makes a difference.

Proner & Proner: protecting motorcyclists in New York

At Proner & Proner, we’ve seen too many cases where insurance doesn’t deliver.

Our job is to make sure you get what you deserve.

- We analyze your policy

- We challenge unfair denials

- We calculate the real value of your case

- We negotiate or sue if necessary

We serve motorcyclists in New York City, Queens, Brooklyn, Bronx, and throughout the state.

Call 1-800-321-1234 or fill out the form on our website.

Your policy may have limits, but your rights don’t.